KANSAS CITY — Sales trends for a number of leading baking companies were encouraging over the past year, but business conditions have remained challenging. Unrelenting competition, a steadily tightening labor market and escalating transportation and other costs were among numerous stress points for baking industry executives.

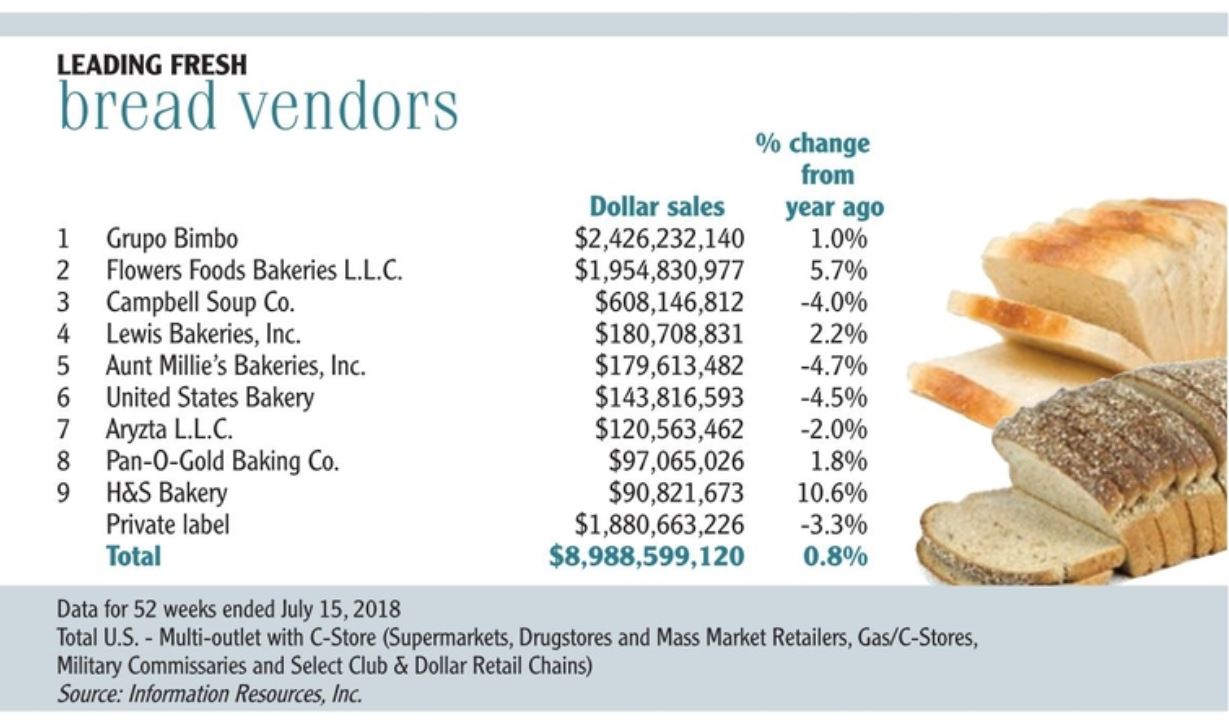

Overall bread sales were marginally higher. For the 52 weeks ended July 15, bread sales were $8,988.6 million, up 0.8% from a year earlier. Unit sales were 3,713.5 million, down 1.5%, according to data from Information Resources, Inc., a Chicago-based market research firm. The average price per unit for bread was $2.42, up 5c from the previous year.

Private label bread dollar sales fell 3.3% and unit sales fell 5.3%. Excluding store brands, which hold a 21% dollar share and 33% unit share, sales of branded bread over the past year were up 1.9% in dollars and up 0.4% in units.

Reflective of escalating costs and pressure on margins, each of the largest baking companies took business restructuring steps over the course of the past year. For Flowers Foods, Inc., Thomasville, Ga., the actions were part of its large Project Centennial, a major restructuring plan launched in June 2016. Two years later, this past June, Flowers executives said it was still in the middle of the endeavor, aimed at cutting costs while spending more on marketing and new product development.

In July 2017, the company announced a voluntary separation incentive plan that, together with other initiatives, resulted in a net overall headcount reduction of approximately 450 associates, including a 15% reduction in management positions.

Grupo Bimbo S.A.B. de C.V. in April 2018 announced a like-sized program, cutting 15% of the company’s salaried workforce in the United States.

No major changes in its baking business were announced at the nation’s third largest bread baker — Pepperidge Farm, Inc., Norwalk, Conn. At the same time, Pepperidge’s parent Campbell Soup Co., Camden, N.J., abruptly announced a change in top leadership, with Denise Morrison, president and chief executive officer, retiring in May. Two months earlier, the company said Mark Alexander, a longtime executive, was leaving the company. During the year, Campbell Soup conducted a strategic review of its businesses and opted to acquire Snyder’s-Lance, Inc. for $6.1 billion. Other segments of the company have been tagged for divestiture, but the fresh baking business is not expected to be among those. The Pepperidge bread business struggled over the past year with a 5% dollar decline in sales and a 4.5% unit decline. Ultimately, struggles with other parts of the Campbell Soup business outweighed the company’s challenges in bread.

In snack cakes, most of the leading baking companies generated sales gains over the past year, with McKee Foods Corp. up 3.5%, Hostess Brands Inc. up 10.4% and Flowers Foods, down 0.8%.

A major disruptive event for the baking industry in the past year was fallout from action the federal government took against Aryzta AG in mid-2017. Inadequate immigration documentation forced about 800 workers to leave Cloverhill Bakery facilities of Aryzta AG and required the company to hire and train new workers equating to a third of the workforce at the plants pressuring Aryzta’s financial results in the months that followed. With the company already struggling with its U.S. business, Aryzta opted to sell the Cloverhill Bakery plants, which it had acquired in 2014. Cloverhill operates two Chicago-area baking plants and produces individually wrapped pastries for retail and food service customers. Its products include Danish pastries, cinnamon rolls, crumb cakes, cake donuts, honey buns and muffins.

Hostess Brands, Inc. and Bimbo Bakeries USA were ready to acquire the business, in transactions announced in February. Hostess Brands acquired Aryzta assets, including a Chicago Cloverhill bakery facility (137,000 square foot) and the Big Texas and Cloverhill brands.

Hostess Brands, Inc. and Bimbo Bakeries USA were ready to acquire the business, in transactions announced in February. Hostess Brands acquired Aryzta assets, including a Chicago Cloverhill bakery facility (137,000 square foot) and the Big Texas and Cloverhill brands.

In the Big Texas and Cloverhill brands, Hostess said it gained distribution strength that will give the company greater access to the club, vending, cash-and-carry and independent convenience stores sales channels. The transaction also significantly expands the Hostess range of offerings in the sweet baked goods category and should reduce the baker’s reliance on co-manufacturing, Hostess said.

C. Dean Metropoulos, Hostess executive chairman, called the acquisition a good fit.

“This is an excellent enabling acquisition for the Hostess breakfast strategy and fills a key strategic gap in our product portfolio,” Mr. Metropoulos said. “The Big Texas and Cloverhill brands and private label partnerships will add significant strength to our growing breakfast business.”

A second facility, in the Cicero, Ill.-suburb of Chicago was acquired by B.B.U. “The acquisition will support the continued growth of our sweet baked goods products,” said Daniel Servitje, c.e.o. of Grupo Bimbo S.A.B. de C.V. “It also optimizes our distribution costs, increases our capacity in the country and enhances productivity, thereby increasing profitability.”

Amid rapid changes in the retail market, surging transportation costs and moves by two major baking companies away from direct-store delivery, considerable attention remained fixed on remaining D.S.D. operations.

In September, Allen L. Shiver, c.e.o. of Flowers Foods, Inc., said D.S.D. remains the best choice for many but not necessarily every product Flowers sells or may sell in the future.

“D.S.D. is exactly the right form of distribution to take care of the product movement that we are experiencing and have always experienced in this fresh bakery category." — Allen Shiver, Flowers Foods

“If you’re a retailer, you want to make sure that your fresh bakery department remains stocked and in very good condition,” he said. “D.S.D. is exactly the right form of distribution to take care of the product movement that we are experiencing and have always experienced in this fresh bakery category. In the cake segment, there’s so much importance on offline displays. And there again, there’s no better way to generate offline displays with a retailer than having our independent distributor in their store, merchandising their displays, making sure that they’re back in there on Saturday afternoons and Sunday afternoons to keep the products in stock. So in the case of fresh bakery, bread, buns and rolls and also cake, we’re very, very confident in our D.S.D. model.

“As we look at other segments of the store, primarily in the perimeter, we have interest there, but they may not lean in the direction of D.S.D. We have to be very careful that we don’t overload our independent distributors with too many items. They need to be handling the items that are generating very attractive turns. But as we look at growth of the company, it does not have to be D.S.D.”

In the cake market, a reversal of fortune at Hostess Brands Inc. represented a major development during the year. Hostess had been riding a powerful wave in the five years since the company returned to the market after bankruptcy in 2013.

In March 2018, the company’s longtime president William D. Toler retired and was succeeded in early May by Andrew P. Callahan (C. Dean Metropoulos served as interim president and c.e.o. between the two).

Mr. Callahan most recently was president of North American Foodservice and International at Tyson Foods, Inc. and earlier was president of Retail Packaged Brands at Tyson. At Hostess, he experienced something of a “baptism by fire,” contending with the challenges of integrating the new facility acquired by Aryzta, a sudden policy change at a major retail customer cutting sharply into sales and serious cost headwinds.

In a call with investment analysts Aug. 7, Mr. Callahan characterized the company’s results as a “significant miss versus expectations” and cited “quickly escalating inflationary costs” together with the effects of the moves by the customer.

In early morning trading on Aug. 8 on the Nasdaq exchange, Hostess shares tumbled 18%, closing at $11.48, down from $13.94 the previous day. In the month that followed, Hostess shares rallied to just north of $12, about 20% beneath the 52-week high of $15.36.

Cereal struggles continue

The ready-to-eat cereal category continued to trend downward in 2018, as dollar sales in the category fell 1.5% to $8,446.4 million in the 52 weeks ended July 15, according to I.R.I. While General Mills, Inc. and Post Holdings Inc. posted nominal year-over-year sales gains, dollar sales at Kellogg Co. fell 3.5% and private label sales dropped 5.7% during the period, according to I.R.I.

To attract consumers back to the category R.-T.-E. cereal makers are broadening their product offerings.

Noting the competitive nature of the cereal category, Jonathon J. Nudi, senior vice-president and group president of North America Retail at General Mills, said the company’s plan is built on “big growth ideas and strong fundamentals.”

“Over 20% of our portfolio will have improved taste news, which is improving growth driver, and we’ll continue to launch compelling innovation, including Cheerios Oat Crunch, as well as two new seasonal Dippin’ Dots cubes that feature popular ice cream flavors over the summer period,” Mr. Nudi said.

General Mills also has partnered with farmers to bring Kernza, a long-rooted perennial, to market as part of a new Kernza honey crunch cereal launch.

Kashi Co., a business unit of Kellogg Co., is introducing Kashi by Kids, a range of organic ready-to-eat cereal featuring ingredients such as chickpeas, purple corn and red lentils.

Kashi Co., a business unit of Kellogg Co., is introducing Kashi by Kids, a range of organic ready-to-eat cereal featuring ingredients such as chickpeas, purple corn and red lentils.

Kashi by Kids is the brand’s first product line developed for children and was co-created with the Kashi Crew, a team of five 12- to 17-year-old chefs and bakers, according to the company. Varieties include Berry Crumble, Honey Cinnamon and Cocoa Crisp, and contain at least 18 grams of whole grains, 3 grams of fiber and 8 grams or less of sugar per serving.

The company said it plans to continue collaborating with the Kashi Crew to develop additional products.

Post Consumer Brands, a business unit of Post Holdings, Inc., St. Louis, unveiled a large number of new cereals this summer.

The introductions includes collaborations with Cold Stone Creamery and Mondelez International, Inc. as well as spin-offs and flavor extensions of its signature brands.

Post’s Malt-O-Meal brand teamed up with Cold Stone Creamery to create two new ice cream-flavored cereals. Strawberry Blonde cereal features honey graham and strawberry-flavored cereal with marshmallows, and Birthday Cake Remix cereal features birthday cake-flavored cereal with chocolate flavored marshmallows.

Driven by consumer request, Post said it also brought back its original Honeycomb cereal shape and flavor.

Driven by consumer request, Post said it also brought back its original Honeycomb cereal shape and flavor.

While Post’s 13 new cereals will be available nationwide, the company also added two Walmart exclusives to its lineup: Nilla Banana Pudding cereal and Golden Oreo O’s cereal.

“We continue to listen closely to our consumers and evolve our brands to deliver some of the best tasting cereals available,” said Roxanne Bernstein, chief marketing officer at Post Consumer Brands.

Nostalgia is the calling card behind the launch of a new line of R.-T.-E. cereals from Funko, Inc., an Everett, Wash.-based pop culture consumer products company. FunkO’s cereal hit store shelves this summer and features more than 40 characters associated with pop culture, including Batman, Batgirl, Huckleberry Hound, Beetlejuice, Freddy Krueger and Pennywise.

Each box of cereal includes a corresponding miniature Pocket Pop! figure, and the back panel includes additional themed activities, puzzles and games.

Cookies on the upswing

In the 52 weeks ended July 15, dollar sales in the cookies category totaled $7,808.9 million, up 3.3% from the same period a year ago, according to I.R.I. Unit sales in the category also improved, rising 1.9% to 2,934.1 million.

A year ago, the cookie category was on the decline, with most of the top cookie vendors experiencing a slip in sales. In the most recent 52 weeks ended July 15, though, year-over-year cookie dollar sales were up at Mondelez (2.6%), McKee Foods Corp. (5.8%), Pepperidge Farm, Inc. (7.3%), Traditional Baking Inc. (8.1%), General Mills, Inc. (21%) and Bimbo Bakeries USA (5.8%), according to I.R.I. Declines were noted at Kellogg Co. (down 5.3%) and Lofthouse Foods (down 1.6%).

The gains in the category occurred alongside innovation news from players on the periphery of the category.

Girl Scouts of the USA on Aug. 14 unveiled a new cookie set to join the portfolio in 2019: Caramel Chocolate Chip. The gluten-free cookie will be available in select areas and joins the returning gluten-free Toffee-tastic cookie that was first introduced in 2015.

Girl Scouts of the USA said the new cookie features “rich caramel, semi-sweet chocolate chips, and a hint of sea salt in a chewy cookie.”

Girl Scouts of the USA said the new cookie features “rich caramel, semi-sweet chocolate chips, and a hint of sea salt in a chewy cookie.”

Meanwhile, at 7-Eleven, fans of the convenience store’s frozen beverages received a surprise when the company introduced Slurpee cookies. The cookies come in a 10-pack and have been created to mimic the taste of a cherry Slurpee.

Also in August, C.H. Guenther & Son acquired Cookietree Bakeries, producer of premium thaw-and-serve cookies, bake-and-serve cookie dough, brownies and scones.

Founded in 1981 by Greg Schenck, Cookietree supplies quick-service restaurants, fast-casual restaurants, club stores and retailers from its manufacturing facility in Salt Lake City. The business will continue to operate under the Cookietree brand out of its existing facility.

In addition to C.H. Guenther & Son’s acquisition in the category, Mondelez International in 2018 completed the acquisition of Tate’s Bake Shop, a premium cookie brand, for approximately $500 million. The company said it will operate Tate’s as a separate, standalone business under its current management team from its Long Island, N.Y., headquarters.

“The Tate’s Bake Shop acquisition represents the type of bolt-on transaction that will leverage our strengths and drive growth and value for our shareholders,” said Dirk Van de Put, chairman and chief executive officer of Mondelez International. “Tate’s on-trend products complement our existing biscuits portfolio and provide access into the fast-growing premium cookie segment. We‘re excited to begin working with the Tate’s team to expand the reach of this beloved authentic brand to more consumers around the world.”

Tate’s Bake Shop previously was owned by The Riverside Co., a global private equity firm, and other shareholders, including founder Kathleen King.

Recall can’t keep cracker sales down

Overall dollar sales for the crackers category increased marginally year over year to $6,983.5 million in the 52 weeks ended July 15, according to I.R.I. The increase reflected strength in such venerable brands as Cheez-It, Pepperidge Farm Goldfish and Nabisco Ritz, which helped offset year-over-year declines in several sub-categories, including crackers with fillings and saltines.

The cracker category was not without its challenges this past year, though. A product recall linked to whey powder from a third-party ingredient supplier led Campbell Soup Co. to recall 3.3 million units of its Pepperidge Farm Goldfish crackers on July 23.

In addition to Goldfish crackers, other crackers that were recalled due to the potential presence of Salmonella linked to the whey supplier included certain Ritz Cracker Sandwiches and Ritz Bits products distributed by Mondelez Global L.L.C., a division of Mondelez International.

In addition to Goldfish crackers, other crackers that were recalled due to the potential presence of Salmonella linked to the whey supplier included certain Ritz Cracker Sandwiches and Ritz Bits products distributed by Mondelez Global L.L.C., a division of Mondelez International.

On the new product front, the Barilla Group’s Wasa brand is adding new gluten-free crispbread to its line of crackers. Available in original and sesame sea salt varieties, the crispbread is made with potato, amaranth and sourdough. The products are also Non-GMO Project verified and vegetarian.

Meanwhile, PepsiCo, Inc., Purchase, N.Y., is stepping outside the chip category by launching Doritos in a cracker format. The product initially is available in Australia in four bold varieties — Cheese Supreme, Mexicana, Texan BBQ and Sweet Chili & Sour Cream — but could make its way to the United States if the product meets the adventure-seeking millennials market that PepsiCo has its eyes on.

“Doritos Crackers are an exciting way to attract a new consumer base to the biscuit category in the form of millennials, who are the heartland of Doritos,” said Alison Silver, brand manager, Doritos. “The brand has a cult following with the young and hungry, and we are thrilled to be able to deliver them with an exciting new way to enjoy iconic Doritos flavors.”

Sweet goods

Indulging in sweet baked goods is never far from the consumers’ mind.

In the 52 weeks ended July 15, dollar sales in the pastry/donuts category totaled $3,522 million, up 2.2% from the same period a year ago, according to I.R.I. The biggest boost came from the muffins sub-category, which experienced an 11.8% increase in dollar sales during the period behind strong private label sales and gains at Bimbo Bakeries and McKee Foods.

The pastry/Danish/coffee cakes sub-category delivered $1,276.6 million in sales during the period, down 0.9% from a year ago. Meanwhile, the donuts sub-category decreased 0.6% to $1,332.2 million, according to I.R.I.

McKee Foods Corp. is adding to its Little Debbie lineup with the launch of Double Chocolate Mini Donuts in a portable, shareable bag. The company described the new variety as “a delicious chocolate cake donut covered in a chocolatey fudge.”

McKee Foods Corp. is adding to its Little Debbie lineup with the launch of Double Chocolate Mini Donuts in a portable, shareable bag. The company described the new variety as “a delicious chocolate cake donut covered in a chocolatey fudge.”

“Chocolate lovers will unite over this double dose of chocolate indulgence that can be enjoyed any time of the day,” said Gary Torner, new products manager.

Drake’s Coffee Cakes, a sweet good that was discontinued last fall, returned to store shelves in 2018. McKee Foods, which has owned the Drake’s brand since 2013, said the coffee cakes will be available in supermarkets, supercenters, value retailers and convenience stores throughout the eastern United States.

Coffee Cakes are made with a cinnamon streusel topping and were first introduced in 1930. McKee acquired the Drake’s brand from Hostess Brands, Inc. after that company declared bankruptcy in 2012.

At Hostess Brands, the roll-out of Bakery Petites continues to give the company a boost.

“The Bakery Petites platform specifically continues to build distribution and added 36 basis points to our market share for the quarter,” said Andrew P. Callahan, president and c.e.o. of Hostess Brands, during an Aug. 8 conference call. He added that 91% of Bakery Petites sales were new consumers to the Hostess franchise and almost 70% were incremental to the category.

Other new product introductions for the company included Jumbo Donettes, multi-packed Danishes and cinnamon rolls.

The bakery snacks category totaled $2,569.9 million in sales during the 52 weeks ended July 15, according to I.R.I., up 0.1% from the same period a year ago. Within the category, dollar sales at McKee Foods fell 1.4%, private label sales rose 2%, and sales at Hostess Brands gained 4%.

The bakery snacks category totaled $2,569.9 million in sales during the 52 weeks ended July 15, according to I.R.I., up 0.1% from the same period a year ago. Within the category, dollar sales at McKee Foods fell 1.4%, private label sales rose 2%, and sales at Hostess Brands gained 4%.

Mid-way through the third quarter signs pointed to continued challenges in the baked foods market.

“We continue to monitor the lingering effects on our business caused by the quality issues we experienced due to inferior yeast received in the second quarter,” R, Steve Kinsey, Flowers’ chief financial and chief administrative officer, said in an early-September presentation. “As discussed, when we reported our second-quarter results, elevated turnover in our workforce has continued to pressure our manufacturing efficiencies and margins. In addition, freight costs remain a significant headwind. These pressures are likely to continue through the rest of the year. Overall, the third quarter has started slightly softer than we had anticipated.”