LAKE SUCCESS, NY. — The Hain Celestial Group’s top line is well-positioned for “a very good exit” from COVID-19, said Mark L. Schiller, president and chief executive officer. The business has benefited from the pandemic-driven shift to at-home eating, in line with the broader packaged food industry, and Mr. Schiller noted several competitive advantages in the company’s recent performance.

“Given how we have performed during COVID, given our scrappy entrance into things like hand sanitizer, the amount of innovation that we’re bringing out right now at a time when others are pulling back on innovation, the addition of marketing at a time when others are pulling back on marketing, I think all of that sets us up for a very good exit from COVID, but it’s premature right now to say what does that look like in terms of the P&L,” Mr. Schiller said during an Aug. 25 earnings call.

He summed up fiscal 2020 as a “great year for Hain with terrific results before the pandemic and great execution during the pandemic leaving us with tremendous momentum as we head into fiscal '21.”

Hain Celestial sustained a loss of $80.41 million in the fiscal year ended June 30, which compared with a loss of $183.31 million the year before.

Net sales declined to $2.05 billion for the year, down 2.4% from $2.1 billion the year before. Excluding the impacts of foreign exchange, divestitures, discontinued brands and stock-keeping unit rationalization, net sales increased 3% over the prior year.

“We exited the year with two consecutive quarters of total company sales growth after eight quarters of declining top line,” Mr. Schiller said.

For the fourth quarter, Hain Celestial had net income of $3.24 million, equal to 4¢ per share on the common stock, which compared with a loss of $13.55 million in the comparable period.

Net sales for the quarter were $511.75 million, up 1% from $505.31 million. Adjusted net sales advanced 7% versus the year-ago period.

North America net sales grew 5% to $298.6 million, or 13% on an adjusted basis during the quarter. International net sales declined 3% to $213.1 million and were flat on an adjusted basis.

“Our strategies of simplification, capability building, cost containment and profitable growth have enabled exceptional execution during the pandemic,” Mr. Schiller said. “Many initiatives that were underway before the pandemic accelerated performance within the quarter. Innovation, marketing and assortment optimization have already started delivering top-line acceleration. Initiatives like consolidation of the US and Canada into one North America operating entity, automation in our plants and the elimination of low-margin SKUs were already lowering our costs.

“While we, as most CPGs, have benefited from COVID thus far, we have confidence that the improvements made before and during the pandemic will continue going forward.”

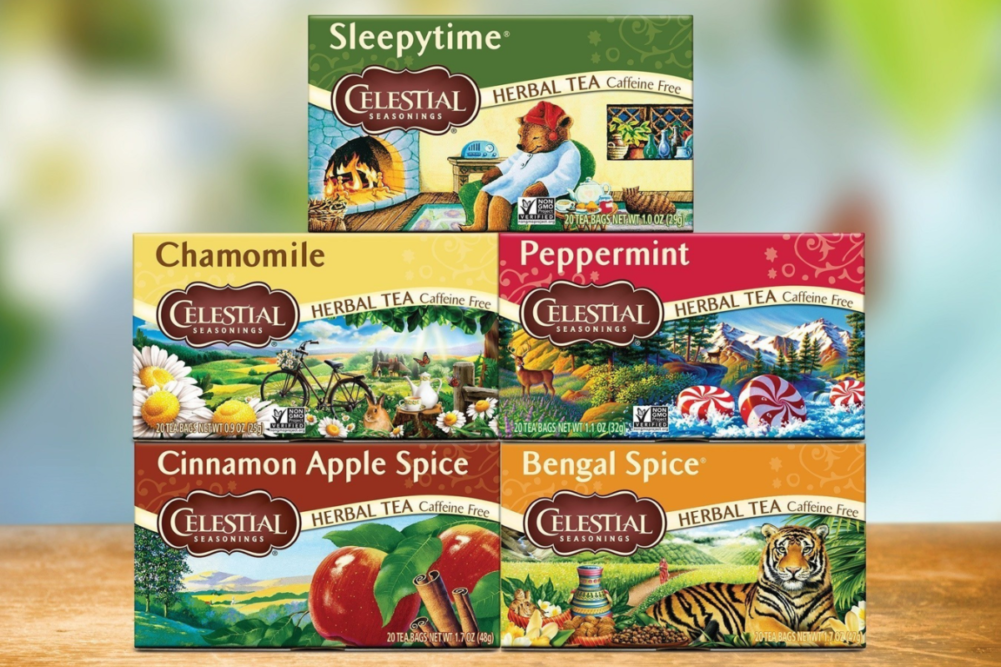

Since the beginning of the pandemic, Hain Celestial’s biggest brands have added nearly 2.5 million new households, representing a 10% increase in household penetration. The company’s Celestial Seasonings business increased household penetration by 27% and repeat buyers by 25% since March, with both metrics outpacing the category, Mr. Schiller noted.

Over the past five months, Celestial Seasonings tea sales surged more than 30%, Mr. Schiller said. He expects continued momentum in the business from the launch of 14 new products featuring functional ingredients.

“They’re not just, ‘here’s another flavor of Sleepytime tea,’” he said. “It’s energy, it’s probiotics, it’s melatonin. It’s a whole bunch of things that really didn’t exist before within the category that is being very, very well received by customers. So we're bringing innovation at times when others aren't, and we're bringing real innovation versus line extensions, and that is going to bode well in terms of us picking up space.”

A category where Hain Celestial has not fared as well is baby food.

“Moms were making their own baby food when they were self-isolating and mashing up bananas and carrots and things that they would typically buy in a packaged good format when they're out and about and need something on the go,” Mr. Schiller said. “We've seen that category start to rebound. But we certainly have been unhappy with the results that we've had in baby over the last five, six months.”

In the snacks category, Mr. Schiller said the company was growing new buyers and repeat rates before the onset of the virus.

“During COVID, we continued to add new buyers, and repeat purchases improved 8%,” he said. “Sensible Portions led the way, growing shares significantly and delivering double-digit top-line growth on top of double-digit growth last year.”

Meanwhile, the company has continued to make progress in its portfolio simplification efforts. During the fourth quarter, Hain Celestial sold or discontinued four brands, including Rudi’s BluePrint, Fountain of Truth and DeBoles, which collectively contributed $27 million in sales and a loss of approximately $1 million in adjusted EBITDA.

“Last month, we also sold our Danival business in Europe after the quarter ended,” Mr. Schiller said. “This brand had sales of $22 million and adjusted EBITDA of $1 million. So as you can see, we continue to have success selling or exiting small and nonstrategic brands that consume a disproportionate share of management time and add supply chain complexity.”

He added there will be additional disposals, but “a lot of the heavy lifting has been done,” noting the company has eliminated nearly $800 million worth of sales over the past two years.

Mr. Schiller’s forward-looking optimism failed to impress investors. Shares of the Hain Celestial Group, Inc. trading on Nasdaq hovered around $31 on Aug. 25, down 10% from the previous close.