The baking industry is feeling the supply chain crunch. At least, that’s what the third quarter (3Q) numbers from BEMA Intel are telling Jennifer Lindsey, vice president of marketing, Corbion, and BEMA Intel panelist.

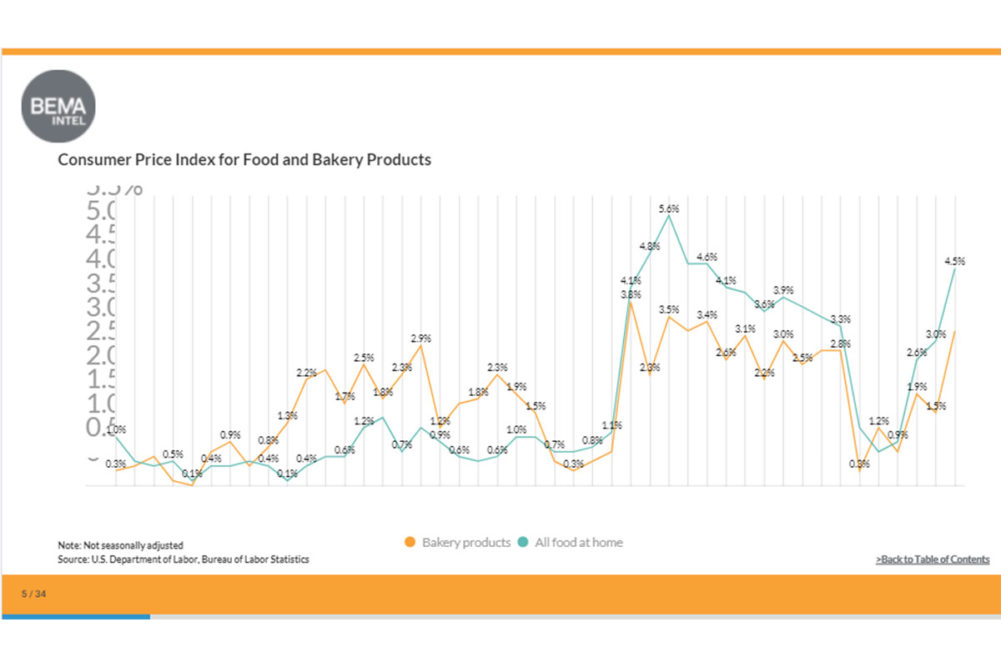

In BEMA Intel’s Industry Indicators report for the Q3 of 2021, all input costs were rising: ingredients, diesel fuel and labor. And the baking industry price increases have been slower to fully take effect in retail than the rest of food companies to pass those rising costs onto consumers. That’s having an impact on both the consumer price index (CPI) and the S&P data for grain-based foods.

In September 2021, the CPI for bakery products was up 3.2% from September 2020 while the CPI for all food at home was up 4.5% from the same month a year ago. And the Grain-Based Foods Share Index and S&P 500 index diverged, with the S&P 500 climbing 17% in the first nine months of the year while grain-based foods were up a modest 1.9%.

“Investors are looking at grain-based food companies and seeing that these companies are having a harder time maintaining their profitability,” Ms. Lindsey said.

She attributed this to the two- to three-month lag effect of passing price increases through to the retailer with bakery products that tend to have a shorter shelf life.

“Bakers are getting hit with these increased raw material costs, and it’s eating into their profitability,” she said. “They’re trying to pass it on to the consumer, but they have this 60- to 90-day squeeze to content with.”

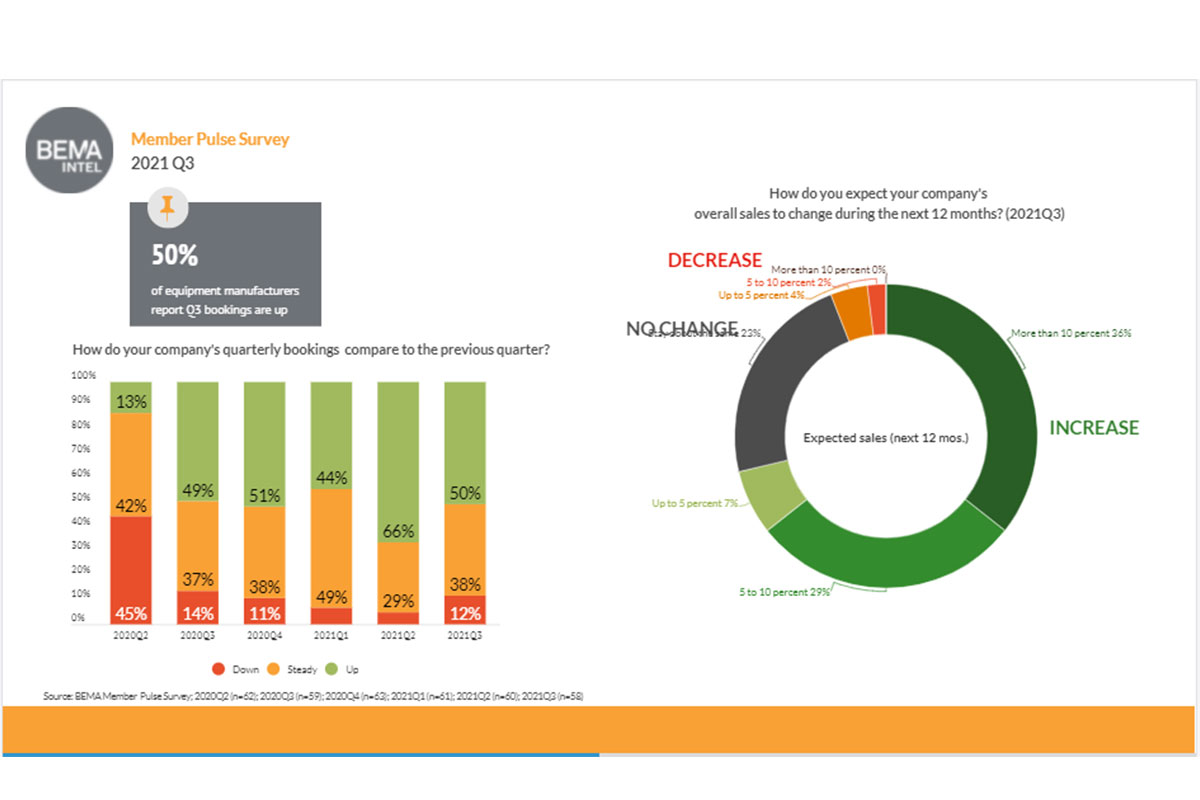

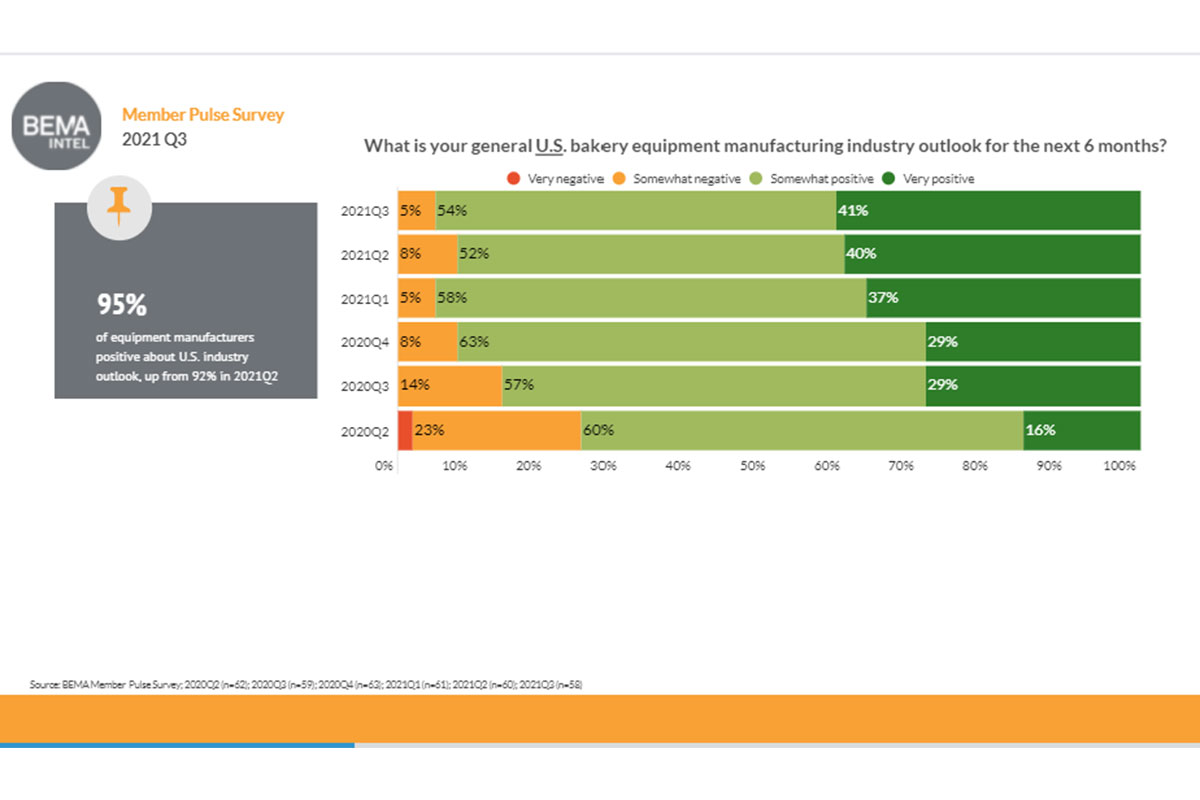

Despite dramatic increases in bakery ingredient indexes, diesel fuel and labor costs, bakers still show no signs of slowing down on their investments. BEMA Intel’s Member Pulse Survey for Q3 of 2021 surveyed bakery equipment manufacturers about bookings and business outlook from quarter to quarter, and BEMA members remain optimistic.

Ninety-five percent of equipment manufacturers reported feeling positive about the industry outlook for the next six months, up 3% from Q2. Fifty percent reported bookings were up in Q3, and 72% expect sales to increase over the next 12 months.

“People are still positive because bookings remain strong into the end of the year and backlogs remain at record levels,” said Tim Cook, chief executive officer of Linxis Group and BEMA chairman. “As long as that is the case, it is hard to be pessimistic.”

Despite the squeeze seen in the Industry Indicator numbers, bakers continue to see strong demand for baked goods, and that translates to a need for efficiency. IRI reported that dollar sales for the commercial bread aisle remain strong and even increased from Q2 to Q3 in 2021. The same was true of hamburger and hot dog buns. Labor struggles mean a need for automation, which spurs capital investment.

“The underlying drivers haven’t really changed,” said Jason Ward, president of AMF Bakery Systems and BEMA board member. “Bakers are looking for solutions to automate production processes and improve efficiencies and productivity. Those investments are fueled by continued strong demand for their products from consumers and a low interest rate environment as well. Those are the same drivers we’ve seen for the last year or so.”

Bakery equipment suppliers, however, are not immune from the supply chain challenges. The top two issues that BEMA members cited in the Member Pulse Survey involved increased raw material costs and transportation and logistics costs. Both were up in concern from Q2, though transportation and logistics costs jumped from 68% to 77% of members saying this was a top challenge.

COVID-19-related challenges were fourth on the list, but they had increased from 39% to 59% of members listing it as a top challenge from Q2 to Q3, respectively. While issues about new variants are real, Mr. Cook doesn’t expect them to overcome supply chain and workforce challenges.

“The industry has already weathered a bad COVID storm and figured out how to manage it,” he said. “Unless the omicron variant gets much worse, the challenge seems identifiable and manageable. On the other hand, supply chain issues are here to stay for at least another year, and it is not something that we can aptly identify or manage.”

Mr. Ward echoed that sentiment regarding the supply chain situation.

“It’s hard to fully convey the disruptive nature of supply chain that we’ve been experienced over the past few months,” he said. “It’s one thing to have known shortages or long lead times or price inflation. Those aren’t easy or fun challenges, but each is manageable. What’s different in this case is the constant changes, last-minute delays and ever-changing ability of our suppliers to meet timelines.”

This squeeze being felt by bakery equipment manufacturers with their own rising costs will prevent them from being able to take full advantage of the investment fever bakers are feeling these days.

“By and large, our customers are telling us they are willing, ready and able to invest, so that leads us to be positive,” Mr. Ward said. “Does that mean will be able to maximize that opportunity as an industry? No, because we aren’t able to move as much through the pipe collectively because of all the supply chain disruptions and labor challenges. But I do think customers and suppliers are working together through these things in really important ways with high transparency and strong proactive communication.”

Another reason the industry remains optimistic, Mr. Ward said, was that these concerns will eventually work themselves out.

“Fundamentally, this is a supply and demand dilemma as well as a break down in global transportation and logistics,” he said. “What we know is that logistics challenges will be solved over time, and we also know that supply and demand will always find an equilibrium.”