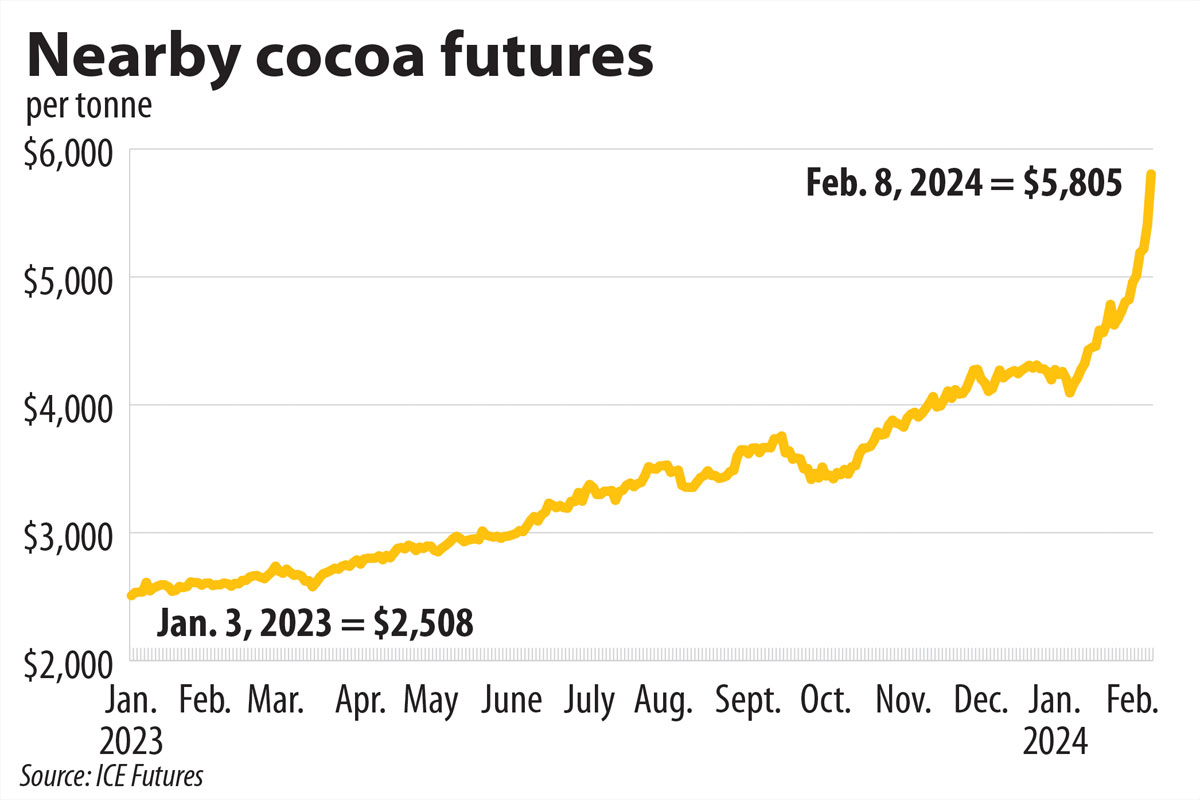

KANSAS CITY — Cocoa bean futures prices set all-time highs in New York and London multiple times during the week of Feb. 5, driven by tight global supplies with no significant break expected near term. The market is watching the potential impact of cocoa and chocolate demand.

The nearby New York (ICE Futures US) cocoa bean future closed at a record-high of $5,805 a tonne on Feb. 8, up $395, or 7%, for the day after hitting a high during the session of $5,874 per tonne. The nearby contract is up about 38% since the end of 2023 and has more than doubled since the end start of 2023. The London (ICE Futures Europe) nearby cocoa bean contract set record highs daily during the week, and is up more than 100% from a year ago.

Source: ICE Futures

Source: ICE FuturesFresh forecasts of a third year of a global cocoa deficit, possibly stretching into a fourth year in 2024-25, have driven prices higher. Recent forecasts have called for a larger global deficit in 2023-24 than forecast earlier in the season. Cocoa bean arrivals at ports in the Ivory Coast and Ghana, the world’s two largest cocoa bean producers, since the start of the 2023-24 marketing year on Oct. 1 were running about 35% behind the same period a year earlier. Production has been decimated by disease in cocoa trees and adverse weather in West Africa.

The impact has been noticed in chocolate sales, with major producers indicating lower unit sales after raising prices in recent months. Mondelez International, Inc. mentioned high prices for cocoa and sugar as inflationary influences in the current fiscal year. The Hershey Co. said it expects moderate net sales growth of 2% to 3% in 2024 but flat earnings per share due in part to higher costs for cocoa and sugar. Barron’s noted that Hershey could face a 30% to 90% increase in cocoa costs, depending on inventory and forward coverage.

Several companies raised prices for their chocolate-containing products in 2023 but saw lower unit sales.