WASHINGTON— The outlook for sugar markets this year is for domestic prices to follow a world market beset with a variety of production issues from major producing countries.

That was the gist of a comprehensive overview delivered Feb. 16 at the 100th annual US Department of Agriculture Agricultural Outlook Forum. Handling the compelling narrative was Jeff Dobrydney, senior vice president at JSG Commodities, Norwalk, Conn.

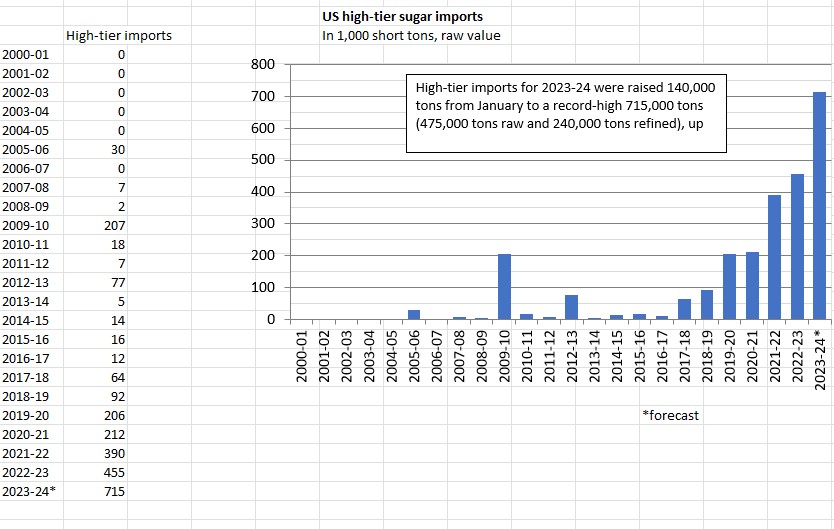

Dobrydney outlined a situation in domestic and world sugar he said was unparalleled in the commodity’s history. The United States is dependent on sugar imported from some parts of the globe for the first time despite ostensibly prohibitive freight and physical premium costs. As a result, Tier 2 (high-duty imports) sugar has been competitive to the point of tripling its market share over the past three years.

“Due to the consecutive years of domestic beet issues, market response consequences, a failure in Mexico to properly invest in older sugar cane, an El Niño-driven drought that caused back-to-back massive Mexican crop failures, including the current crop, which is 25% complete, the domestic market in the United States first looks to global prices in order to both establish market values for futures and physicals, and due to a recent 12-year high in global prices, the literal domestic sugar perfect storm has developed,” Dobrydney said. “High prices, consequential fundamental turmoil, inflation, post-pandemic supply chain realities, an upcoming election, a new farm bill perhaps. The domestic sugar market has rarely, if ever, been in such a predicament before.”

With that as precis, Dobrydney launched into a global sugar outlook for 2024. A nominally stable, tight-supply environment is likely to keep world prices elevated well above the 10-year average price of 15¢ a lb as US prices remain tightly tethered to the global market’s dynamics and forward pricing risks, he said. That relationship is critical to understanding the present and future implications on sugar in the US-Mexico-Canada Agreement.

The world benchmark contract for raw sugar trading, Sugar No. 11, is key to that understanding for several reasons, Dobrydney said. First, the second-straight Mexican crop failure is worse than projected on the heels of consecutive years of US sugar beet production issues that led in some cases to declarations of force majeures. The result was increased reliance on high-tier duty-paid sugar to meet demand. The domestic demand for high-tier global sugar needs will exceed 1.2 million tonnes in fiscal 2024, JSG projected. High-tier needs represent around 10% of total domestic demand, he said. In this environment, No. 11 values dictate raw sugar domestic No. 16 prices, which in turn will impact refined sugar values for the foreseeable future, he said.

Dobrydney outlined the typical price outlay for Tier 2 sugar based on a March 2024 No. 11 projection of 23¢ a lb. He added 15.35¢ for Tier 2 raw sugar entry into the United States, around 4¢ for current freight rates in the era of the world at war and drought at the Panama Canal and 0.50¢ for the physical premium for March-May Central American sugar. He subtracted 0.7¢ polarity adjustment for a total c.i.f. duty paid price of 42.15¢, which compared with 42.25¢ a lb as the mid-February price on Sugar No. 16 summer futures contracts.

“In our view, 20¢ is the new 15¢ in world sugar,” Dobrydney said. “The rally that’s transpired post-pandemic was for good, fundamental reasons, first for post-pandemic reasons, then for supply and demand reasons. S & D in the world market got tighter. We got up to 28¢ last year before what was essentially a cataclysmic pullback that the computers really exacerbated in December, a 35% reduction in price. Every major global player then needing to buy sugar started doing so. Immediately prices recovered to 23.5¢ to 24¢ a lb and that’s where we find ourselves right now, and don’t see that situation in the world market changing any time soon.”

Source: Sosland Publishing Co.

Source: Sosland Publishing Co. The historical view shows that constant surplus back in 2011 led to price declines and then sideways movement from 2017 to 2020. Since that time, hand-to-mouth supply issues have drawn down world stocks, partly fueling the rally in global prices, he said. Of the top global producers, only Brazil has stepped up to meet demand. Other producing countries have been affected by El Niño drought and monsoons in India, production cut in half in the past six years due to drought in Thailand or have shown no inclination to ramp up production (China and the European Union). For North America, the upper northeastern quadrant of Mexico, where most of the country’s sugar production takes place, has been decimated by drought. That led JSG to downgrade its Mexico production projection to 4.5 million tonnes, a pullback of 1.5 million to 1.6 million tonnes from Mexico’s proven capability a few years earlier.

“The point is Sugar No. 11 isn’t the cocoa market that is completely out of control in the hands of the computers with the humans just along for the ride,” Dobrydney said. “I’m not here to tell you sugar is going to 30¢ a lb, but if that Brazil harvest has a problem this year, sugar’s going right back to where it was in the prior 12 months.”

Funds, banks and investors with sugar in their portfolio were active in the market in 2023 but largely have exited after a messy December ended the year on a bad note, Dobrydney said. If those players re-enter the market in significant ways, the No. 11 price will be supported, he said.

“This market is a situation where at the end of the day, consumers should be concerned about prices, but in a larger-scale picture of inflations and recession, sugar isn’t the only concern for the consumer,” he said.

Global production issues Dobrydney and others in the sugar trade are watching include Mexico’s crop declining to 4.5 million tonnes; drought and older cane in Central America; El Niño-driven acreage declines in India, a major exporter just two years ago; Thailand’s drought, heat and conversion of acres to casava that could lower production to 7 million tonnes; the EU’s transformation from exporter to importer; and China’s expected demand of more than 16 million tonnes as a consistent physical buyer.

“And the bottom line is — cliché as it sounds — if Brazil doesn’t perform as it did last year, at record levels, world sugar is going to be at a deficit — an even bigger deficit than it already is now,” Dobrydney said, noting the six weeks ending with March will be critical to that crop.

Market watchers should follow any new investment in No. 11 Sugar, he said. Specifically, whether index funds, hedge funds, banks and other players shift some money from the wild cocoa market into sugar, to which sugar prices likely will respond. The consistently high premium ($130 to $150 for about two years) for white sugar indicates strong global demand for refined over raw. Indian raw sugar exports are off the table for the foreseeable future, and global warfare, Red Sea piracy and Panama Canal drought will continue the risks involved in global freight. If crude oil prices, which have been mostly steady despite those geopolitical challenges, were to shoot higher, commodity prices will follow, including sugar.

The price outlook from JSG for 2024 is for No. 11 to range between 20¢ and 30¢ a lb with a 39¢ to 49¢ a lb No. 16 market following.

The next major sugar forum will be the International Sweetener Colloquium opening Feb. 25 in Aventura, Fla.

“I believe the conversation in Florida will be somewhat contentious, because we’re going to hear about high world prices, the situation in Mexico and the need to book sugar now,” Dobrydney concluded.